Most freelancers make a VAT return at the end of each quarter, with any payment you owe due on the 10th of April, July, October and January. Please note that from 1 July to 31 December 2020 these VAT rates have been reduced to 5% and 16%, in response to the Corona crisis. Which rate you need to charge your clients will depend on what kind of work you are undertaking. In Germany, VAT is charged on most goods and services, at one of two rates: 7% and 19%. This is a tax on goods and services which also applies to the services you offer as a freelancer.

If you are a freelancer working in Germany and earning more than 22,000 EUR per year, you will most likely have registered to pay value-added tax (VAT), or Umsatzsteuer in German.

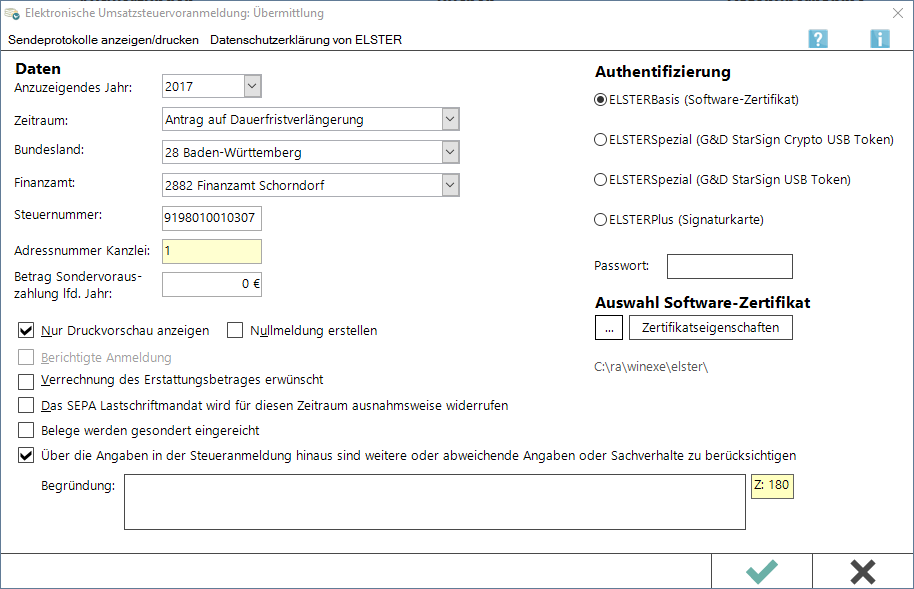

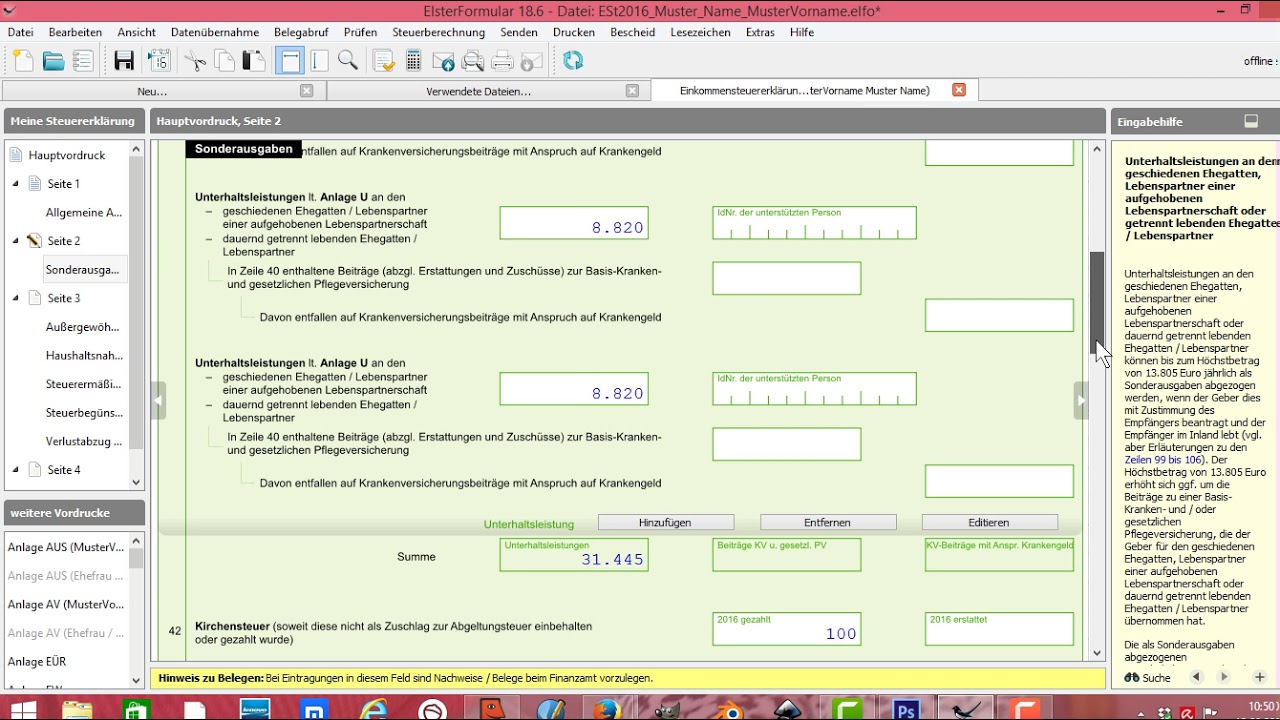

Here we walk you through how to file your VAT (or Umsatzsteuer) return and submit it to ElsterOnline, the German tax office’s online service. Submitting your VAT return to the Finanzamt doesn’t need to be a headache.

0 kommentar(er)

0 kommentar(er)